Why Do Nordic Countries Still Have Their Own Currencies?

The Nordic Choice: How Monetary Independence Protected Sweden and Denmark.

Picture this: During the 2008 financial crisis, as the euro tumbled and Southern European countries faced harsh austerity measures, Sweden and Denmark stood strong. While their neighbor Finland, bound by eurozone rules, struggled with policies designed for Germany and France, these two Nordic nations could chart their own course.

This wasn't luck – it was the result of conscious choices to maintain control over their own money.

Today, as Europe faces new economic storms, Sweden and Denmark's decision looks wiser than ever. While the European Central Bank tries to find one-size-fits-all solutions for 20 different economies, the Swedish Riksbank and Danish Nationalbank can act quickly to protect their citizens' interests.

The Choice for Independence: A Historical Perspective

When the euro arrived, both Sweden and Denmark faced a crucial choice about their economic future. The statistics tell a clear story: according to official referendum records, Swedish voters rejected euro membership in 2003, with 55.9% choosing to keep the krona. Danish voters had made the same choice three years earlier, with 53.2% voting to retain the krone.

But these weren't just numbers on a ballot. Riksbank analysis shows that behind these decisions lay deep concerns about:

Keeping control over economic decisions

Maintaining the flexibility to handle local challenges

Protecting the ability to respond to unique Nordic economic conditions

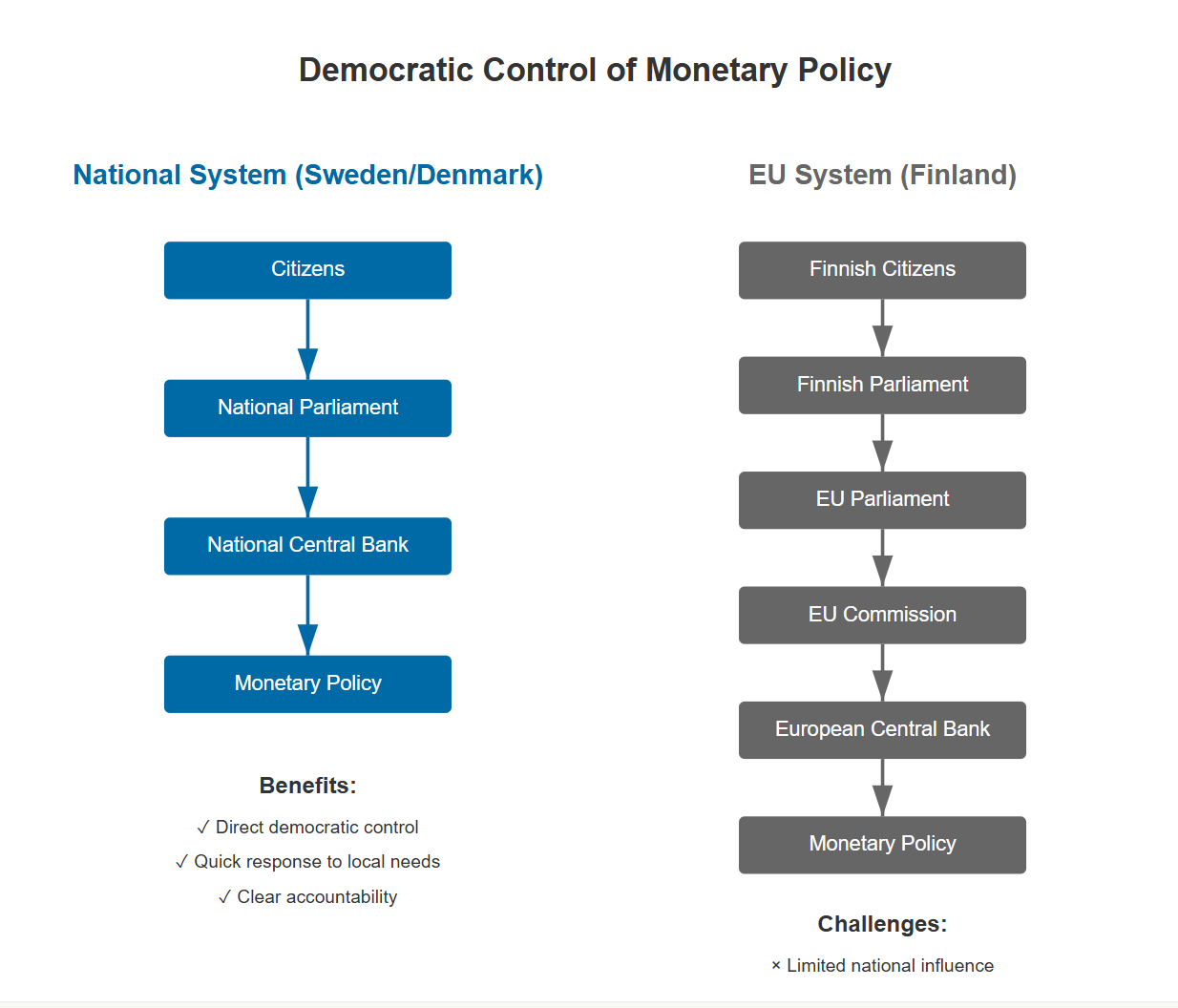

Ensuring democratic oversight of monetary policy

Finland chose differently. The Bank of Finland records show it embraced the euro from the start – creating what economists call a "natural experiment" in different monetary approaches among similar Nordic economies.

Crisis Management: A Tale of Two Approaches

When the 2008 financial crisis hit, this experiment faced its first major test. The contrast between Finland and its independent neighbors proved revealing.

Sweden's response demonstrated exactly what monetary independence means in practice. The Riksbank moved swiftly, cutting interest rates from 4.75% to 0.25% according to central bank records. The flexible krona naturally adjusted to help Swedish exporters stay competitive, while specialized lending programs supported Swedish banks. Most importantly, they could act fast without waiting for agreement from Frankfurt.

The results were clear in Swedish economic data: exports bounced back faster than in euro countries, jobs were better protected, and the recovery started sooner, with manufacturing maintaining stronger performance throughout the crisis.

Denmark took a different but equally successful approach. While keeping the krone loosely tied to the euro, they maintained crucial flexibility that allowed Danmarks Nationalbank to adjust policies to match local needs and support Danish banks with targeted measures. As a result, their economy avoided the worst of the eurozone's troubles.

Meanwhile, Finland faced a harder path. Official statistics reveal a deeper economic downturn, a longer road to recovery, higher unemployment, and more pressure on local businesses.

Real Results in Real Numbers

Looking at decades of economic data tells a compelling story about monetary independence. The impact on ordinary people has been significant, particularly in employment and economic resilience. Eurostat figures show that Swedish and Danish workers faced less unemployment risk during tough times, while their economies bounced back faster from setbacks. Public services faced less severe cuts, and young people found jobs more easily.

Trade statistics from Statistics Sweden and Denmark Statistics demonstrate that both countries have thrived in global markets, despite warnings that small currencies would struggle. International investment data reveals strong confidence in both economies, with investors appreciating their stable economic management, quick responses to problems, and clear policy decisions.

Looking Ahead: New Challenges, Same Advantages

Today's challenges – from energy transitions to digital currencies – make monetary independence more valuable than ever. During the 2022-23 energy crisis, Swedish and Danish central banks could target local inflation pressures and support affected industries while protecting their financial systems. This flexibility has proven crucial for maintaining industrial sovereignty and protecting strategic industries from external shocks.

In the realm of energy security, central bank reports demonstrate how monetary independence enables more flexible responses to energy price fluctuations and better protection of domestic industry. Both the Riksbank and Danmarks Nationalbank are also developing digital currency solutions that fit their specific needs, rather than waiting for EU-wide initiatives.

Lessons Learned

Twenty years of experience, documented by institutions from the IMF to the Nordic Council, proves that monetary independence works. Small countries can successfully manage their own currencies, and economic independence strengthens rather than weakens European cooperation. The Swedish and Danish examples show that keeping control of your currency isn't just about monetary policy – it's about maintaining the freedom to choose the right solutions for your people.

■

On Sovereign Europe, I provide educational pieces that build the foundation for understanding European politics beyond establishment narratives. These articles complement my analyses and timely comments to give you the knowledge needed to see through federalist rhetoric and appreciate the importance of national sovereignty.